March 2022

The Case For Change & Accountability at the Holmdel BOE

I have been a resident of Holmdel since 2017. Ever since we came here, I have seen our schools underperform. When I reached out to the BOE and its current members, I did not receive a constructive response to work together to improve what I saw as issues.

I am a little concerned that so far, we have been playing a game of musical chairs. For example, Dr McGarry, who was the previous superintendent, was the one driving the Holmdel 2020 initiative. We took his word for it and voted in favor of this investment. He left shortly after without an explanation to the community or providing a status on how the project implementation was going. Now some of the current board members say that this was before they were elected to avoid accountability.

The way I see this – The school board has a fiduciary duty to the town’s residents. Even if this was before a board member’s time, I expect the board member to have made a determination on whether the project in question was on track and was achieving its objectives when they came onboard. If it was, great! If it wasn’t, then the board needs to course correct and report back to the community on what was missing and how things were going to be brought back on track. Saying it was before your time should never be acceptable!

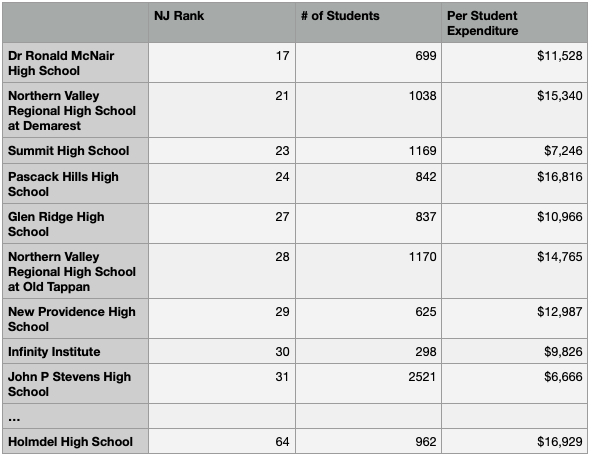

As you can tell from the following stats, our dollars do not go as far in improving the quality of education or rankings as other school districts. I have not included the vocational school districts in this comparison, so that we are comparing our school to similar suburban high schools fairly. We seem to spend more money per student, but are still ranked lower than a lot of other public high schools.

Data from: https://www.schooldigger.com/go/NJ/schoolrank.aspx?level=3

I will not belabor the point by listing every school that is above us here, but I assume you get the point.

The Holmdel 2020 Initiative:

I understand that we had not invested in school infrastructure upgrades for a while, and it’s justified to invest in giving our kids better facilities. But we should also be interested in tracking the ROI on our investment of $40M in this project. How much of these funds went into improving the metrics that drive our rankings? And having made this investment, the least that the community should expect is for the board to share how these metrics have trended quarter over quarter, so we have the confidence that the quality of education is improving and so will our rankings in the future. Anyone who has asked the town to make an investment in the school makes the case that improved rankings will drive up home values and therefore result in better returns for tax payers. We haven’t seen any such improvements in Holmdel yet!

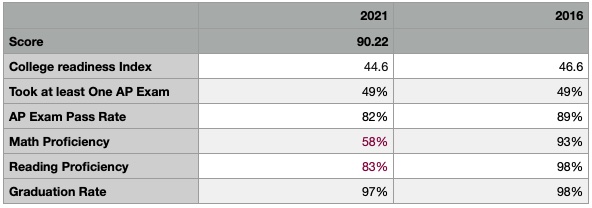

Holmdel Metrics from US News and World Report High – School Evaluation Criteria:

These are the metrics that drive our US News rankings and here’s our current evaluation on each metric:

Source:

Current:

2016:

As you can see, there is a precipitous drop in Math proficiency since 2016. The reading proficiency has also fallen in this period. The obvious question to ask here is, have we lost a number of our good teachers? Each of us has anecdotally heard of teachers leaving or retiring. It would certainly make sense for the board to share these attrition statistics. Also, when filling these positions, do we strive to maintain the same level of seniority/expertise when we hire replacement teachers? Are our kids getting as good of an education as before?

Another argument that is used to explain away similar performance drops is that we lose a lot of students to the county’s vocational school district schools. That is not really relevant here to explain this drop since the vocational schools existed in 2016 as well, and were roughly pulling in a similar cohort from the high school.

We have had an interim superintendent for more than a year. I very much like Dr. Seitz and I believe we are doing him a disservice by keeping this position temporary. I would like to know whether the board has confidence in him? If it does, please confirm this as a permanent position or if it does not, please begin a search for a permanent superintendent so that we can have accountability. Again, I am against playing musical chairs where no one takes responsibility.

One final item that is often mentioned by our current board members is that we were the platinum standard for school reopening. Before coming to that conclusion, I would like to see the studies that the board has reviewed (preferably double blind) before making investments into “UV-C lighting, bi-polar ionization filtration units, antimicrobial coatings on commonly used surfaces, retro-commissioned the District HVAC systems”. Lack of having a cluster of cases does not indicate that these measures are the ones responsible for this (correlation does not imply causation). As you realize, a number of us chose to keep our kids home last year. Before the start of this school year we had vaccines available to our kids 12 years or older. How do we know that these factors have not had an effect in preventing clusters of infections as did our investments into infrastructure improvements? Attributing it to a single factor is not supportable without appropriate studies.

I prefer using data to come to meaningful conclusions, because if you cannot measure it, you cannot improve it. And I haven’t seen meaningful metrics being tracked by the board or shared with us.

That said, I believe that it is time to bring change and new blood to the school board, so that it can be more receptive to our concerns about getting our schools to prepare our kids for a much more competitive future. My advice to the parents in Holmdel – please talk to each of the candidates to make up your mind on who can/will bring about this change. You should specifically be asking each of them what changes they intend to bring about, and what metrics will they track/measure regarding these changes so that we as a community can determine if we are on track and how will they transparently share these metrics at each BOE meeting over their term.

We owe this to our children!

What if – we could have progress without the crushing pollution…

What the lockdown shows us… the earth can regenerate without us and come back even more beautiful.

Here’s Paris, with its streets deserted and in its full glory without any humans outside. And here’s Bangalore, which reminds me so much of the 1980’s Bangalore that I grew up in. I often biked around the city, which is absolutely not possible in today’s Bangalore given the traffic and the unimaginable growth of the city. There is footage from Rome, Venice and New York. All makes you feel we are in a dystopian “I am Legend” world.

But there is something else as well – which is the earth does not need us, instead it is us who needs the earth. And in our pursuit of industrialization and rapid development, we have spoiled this pristine planet. Some of the following pictures show you what just a month of stopping industrial production can mean in terms of pollution.

But there is another way. Do we really need to pollute the planet that we live on just in the name of progress. As is evident from this podcast – The Ezra Klien Show in conversation with MacArthur genius Saul Griffith, or Saul’s post in Medium, it is possible to have a completely electric future based on harnessing renewables. The solar energy coming to the earth is 40,000 TW. Wind energy is about 3,600 TW. Bio fuels is about 90TW and geothermal at 32TW. Our entire consumption as a species is about 10-20TW. So it is entirely possible that with community micro power generation efforts we are able to move completely to an electric future without the pollution and extraction effects of fossil fuels just using solar and wind. Of course we would need to address the variability in power generation from these sources between night and day or seasonal variations. This would mean we need advancement in our storage and transmission technologies to really make this happen. Saul has some calculations in his article that this would need about 1% of the land area for solar collection. Today our roads take up 1% of the land area and roof tops about 0.5% – so this is entirely doable.

Towards this, we have started installing solar at home, but got caught up in first our utility company JCPL denying the size of the installation. Even when we pointed out that we had a much larger shade factor given the trees in the backyard on our retaining wall, they only agreed to a much smaller installation of about 16kW instead of the proposed 26kW system with the understanding that we could expand in a few months when the electricity generated did not meet all our needs. Then came the lockdown from covid-19. We were locked out for a few months, but finally we do have an install date – 8th June. Very excited and looking forward to it.

Another aspect to consider is looking at the total energy usage that we all have. For us the electric consumption is extraordinarily large – 22kWH over a year. Obviously I have some errant devices that are sucking away so much of power – but given we moved to this home 2 years ago, I have no clue what is this energy hog. Towards this, I am installing a device called IotaWatt that uses current transducers to measure power consumption at each breaker in the box. Once we determine which device needs to be replaced, I am planning on replacing or switching off those devices and using the power capacity to convert my natural gas furnaces to electric ones. While per watt they may be more expensive than natural gas, with your own generation of solar electricity, that should not really matter. Will keep you posted on how our plans proceed…

First they came for…

Looking at the news today, this was very apt to quote…

“First they came for the Communists

And I did not speak out

Because I was not a Communist

Then they came for the Socialists

And I did not speak out

Because I was not a Socialist

Then they came for the trade unionists

And I did not speak out

Because I was not a trade unionist

Then they came for the Jews

And I did not speak out

Because I was not a Jew

Then they came for me

And there was no one left

To speak out for me”

~ German Lutheran Pastor Martin Niemöeller

Why We Chose To Move Our Analytics Platform To The Cloud?

Our analytics platform uses only corporate data stores and services only internal users and use cases. We chose to move it to the cloud. Our reasoning for doing this is as follows…

The usual perception amongst most enterprises is that cloud is risky, and when you have assets outside the enterprise perimeter, they are prone to be attacked. Given the mobility trends of our user population – both from the desire to access every workload from a mobile device that can be anywhere in the world as well as the BYOD trends, it is increasingly becoming clear that peripheral protection networks may not be the best solution given the large number of exceptions that have to be built into the firewalls to allow for these disparate use cases.

Here are some of the reasons why we chose otherwise:

- Cost: Running services in the cloud is less expensive. Shared resources, especially when you can match dissimilar loads would be much more efficient to utilize and therefore would cost less. It makes sense to go to a cloud provider, where many clients have loads that are very different and therefore it makes sense for them to share resources compute and memory, thus reducing the total size of hardware needed to manage their peak utilization. During my PBM/Pharmacy days, I remember us sizing our hardware with a 100% buffer to be able to handle peak load between Thanksgiving and Christmas. But that was so wasteful and what we needed was capacity on demand. We did some capacity on demand with the IBM z-series, but then again our workload wasn’t running and scaling on commodity hardware and therefore more expensive than a typical cloud offering.

- Flexibility: Easy transition to/from services instead of building and supporting legacy, monolithic apps.

- Mobility: Easier to support connected mobile devices and transition to zero trust security.

- Agility: New features/libraries available faster than in house, where libraries have to be reviewed, approved, compiled and then distributed before appdev can use them.

- Variety of compute loads: GPU/TPU available on demand. Last year when we were running some deep learning models, upon introducing PCA our processing came to a halt given the large feature set we needed to form principal components out of. We needed GPUs to speed up our number crunching, but we only had GPUs in lab/poc environments and not in production. Therefore we ended up splitting our job into smaller chunks to complete our training process. If we were on the cloud this would have been a very different story.

- Security: Seems like an oxymoron, but as I will explain later, cloud deployment is more secure than deploying an app/service within the enterprise perim.

- Risk/Availability: Hybrid cloud workloads offer both risk mitigation and high availability/resilience.

Let’s consider the security aspect:

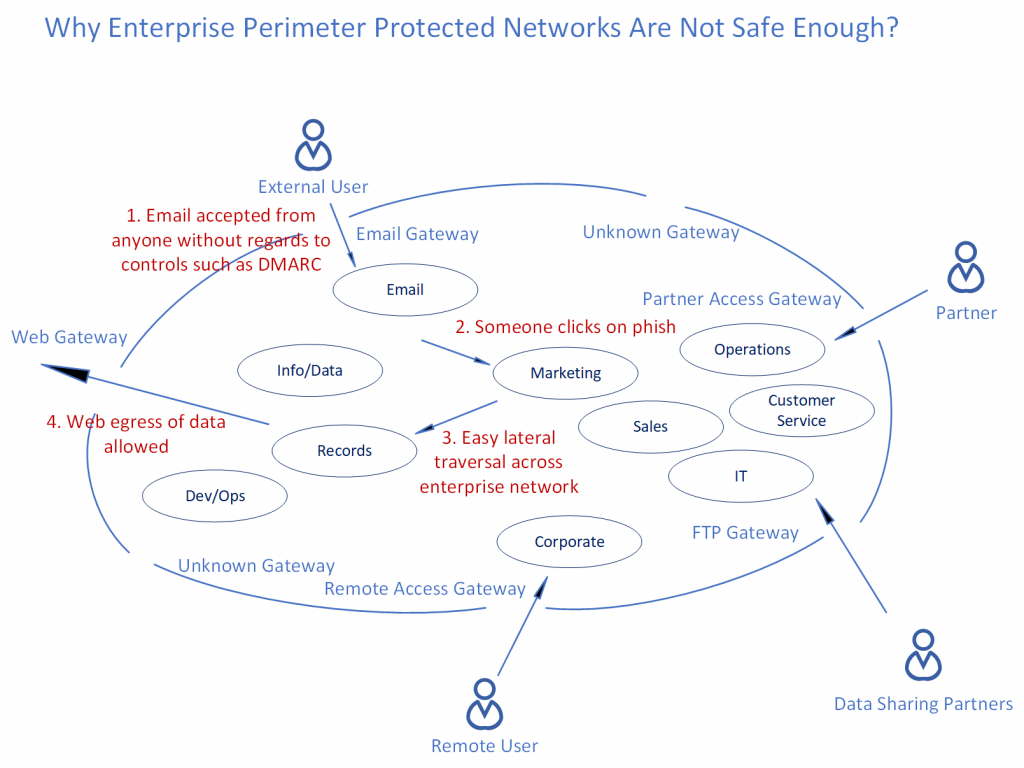

The cost of maintaining and patching a periphery based enterprise network is expensive and risky. One wrong firewall rule or access exception can jeopardize the entire enterprise. Consider the following:

A typical APT (Advanced Persistent Threat) has the following attack phases:

- Reconnaissance & Weaponization

- Delivery

- Initial Intrusion

- Command and Control

- Lateral Movement

- Data Ex-filteration

An enterprise usually allows for all incoming external email. Usually most organizations do not implement email authentication controls such as DMARC (Domain-based Message Authentication, Reporting & Conformance). You would also have IT systems that implement incoming file transfers, so some kind of an FTP gateway would be provided for. You also see third party vendors/suppliers coming in through a partner access gateway. Then you also have to account for users within the company that are remote and need to access firm resources remotely to do their job. That would mean a remote access gateway. You also do want to allow employees and consultants that are within the enterprise perim , to be able to access most websites and content outside implying you would have to provision for a web gateway. There would also be other unknown gateways that had been opened up in the past, that no one documented and now people are hesitant to remove those rules from the firewall since they do not know who is using it. Given all these holes built in to the enterprise perim, imagine how easy it is allow for web egress of confidential data, through even a simple misconfiguration of any of these gateways. People managing the enterprise perim have to be right every time while the threat actors just need one slip up.

As you can tell from the above diagram, the following sequence could result in a perimeter breach:

- Email accepted from anyone without regard to controls such as DMARC.

- Someone internal to the perimeter clicks on the phish and downloads malware on their own machine.

- Easy lateral traversal across the enterprise LAN, since most nodes within the perimeter trust each other.

- Web egress of sensitive data allowed through a web gateway.

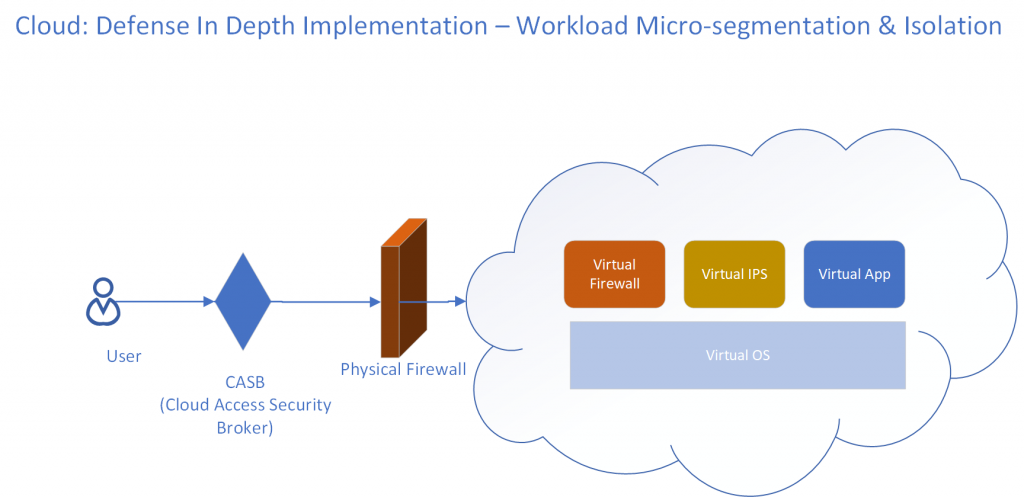

On the other hand consider a Micro-Segmented Cloud workload which provides multi layer protection through DID (defense in depth). Since the workload is very specific, the rules on the physical firewall as well as in the virtual firewall or IPS (Intrusion Protection System) are very simple and only need to account for access allowed for this workload. Additional changes in the enterprise does not result in these rules being changed. So distributed workload through micro-segmentation and isolation actually reduces risk of a misconfiguration or a data breach.

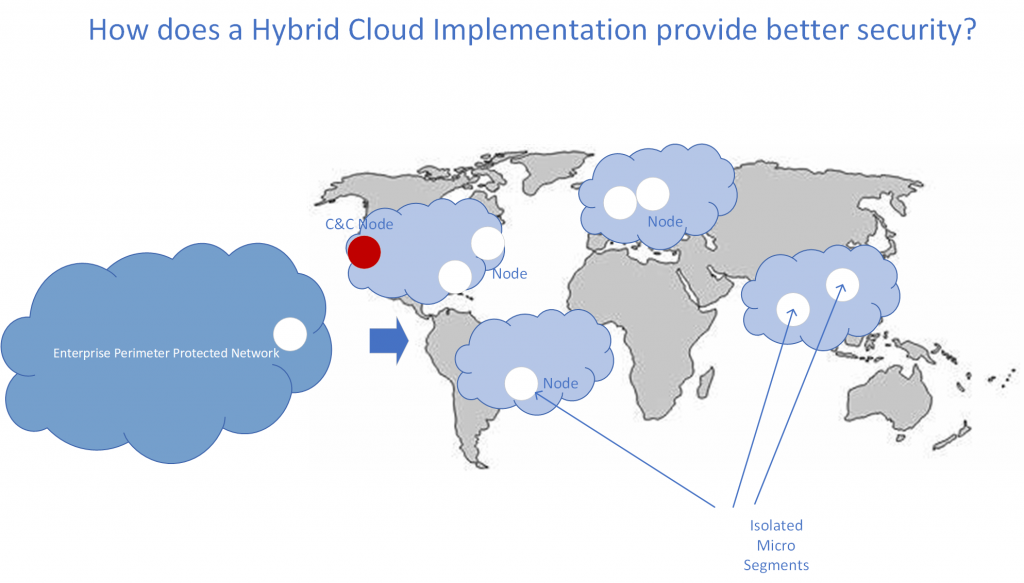

Another key aspect to consider is the distribution of nodes. Looking at botnets, they have an interesting C&C (Command and Control) design; if the C&C node is knocked out, another node can assume the C&C function and the botnet continues its work attacking. Similarly cloud workloads can also implement the same C&C structure and if one of the C&C nodes is victim to a DoS (Denial of Service) attack, another can assume its role. Unlike an enterprise perimeter, a cloud deployment does not have a single attack surface and associated single point of failure, and a successful DoS attack does not mean that all assets/capabilities are neutralized, rather other nodes take over and continue to function seamlessly providing high availability.

It’s time to embrace the micro segmented cloud native architecture where a tested and certified set of risk controls are applied to every cloud workload. The uniformity of such controls, also allow risks to be managed much easier than the periphery protection schemes that most enterprises put around themselves.

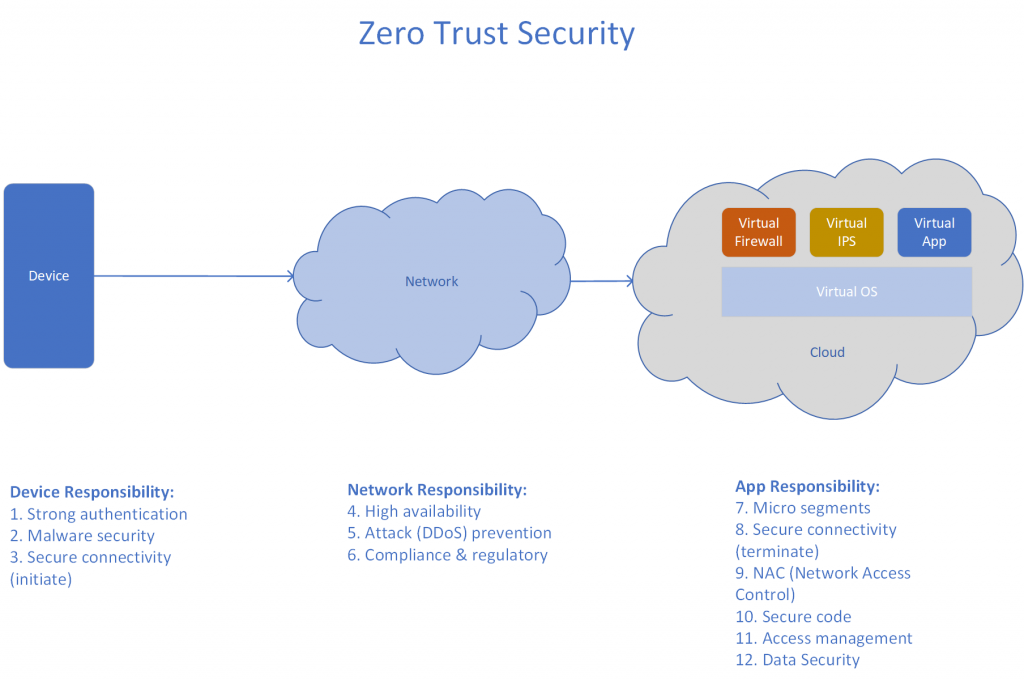

Another important trend that enterprises should look to implement is zero trust security. The following diagram represents the responsibilities for each layer/component when implementing zero trust security. A very good writeup from Ed Amaroso on how zero trust security works is here.

Ex-Animo

My team’s submission at hths.hacks() for a virtual platform for doctors to conduct physical examinations.

Some Covid-19 Related Thoughts…

Reasons

So what happened…I think its clear to every one that we are in the middle of a pandemic with a new virus, one that we do not know much about and are just discovering its structure, understanding its impact on the human body and figuring out its R0 (reproduction number i.e. average number of people who will contract a contagious disease from one person with that disease) and its mortality rate (how deadly is the virus). The R0 appears to be higher (5.7 per some studies) than the early estimates of 2-3.

As if this wasn’t enough of a challenge, we already had a trade war with China with retaliatory tariffs on both sides and then came the ugly spat between Russia and Saudi Arabia which led to a plunge in the global oil prices and some challenges with an ETF (USO) caused oil prices to go negative for a few days when all storage capacity for oil was full and no one was ready to take delivery from oil producers and refiners.

As a result of the pandemic (and related geo political conditions) , in the US we have lost 36.5M jobs the past 8 weeks and the unemployment rate has skyrocketed from 3.5% to 14.7% last month. But there were other reasons, why this crisis hit us so hard. In addition to the demand and the supply shocks that came from this pandemic we had ongoing geo political strains and trade wars; our classic response was to lock down to flatten the curve to not max out our hospital capacity. So it was going to be bad, but it feels worse given a number of stresses that had already been built up in our society:

- Inequity & Inequality: While globalization delivered on overall growth and in aggregate seemed to raise all boats, it wasn’t able to address inequity and inequality within individual countries and in a crisis it appears that more of the suffering and pain is experienced by the poor. Having very meager reserves and sudden loss of employment is not easy to deal with in a global pandemic resulting in food scarcity. There is also a very different death rate experienced by communities of color as compared to others. One way to understand why the lack of reserves matters so much during a pandemic, is the lack of buying power prevents an individual to adjust to the availability of items especially during a breakdown in the food and essential items supply chain. Think about this – a person who buys toilet paper for his/her needs every week, given the break in supply chain they may not find TP on their weekly trip to the store. Without reserves it is very hard to stock up on essentials when the tradeoff is food/healthcare or other necessities…

- Lack of a safety net: Mostly in the US, not having a health safety net and universal health coverage has prevented a number of people and illegal immigrants from either being able to avail testing or treatment. In a global pandemic its important to identify and isolate not just look at the ability to pay for healthcare or legal status of the individual. While congress enacted free testing and treatment, it was a little too late and did not universally cover everyone.

- Unbridgeable ideological fault lines: We have become so ideologically fractured that we cannot even objectively evaluate one another’s arguments as can be seen by one side arguing for closing longer till certain metrics are met while the other side arguing for lifting all shelter in place restrictions in the name of liberty and damage to the economy. At this time, we cannot even have a rational conversation on immigration, guns or abortion. Given this deep divide neither side is willing to accept the other’s arguments on good faith and therefore we do not have a unified response or a coherent public policy. And a dysfunctional federal government has not helped during this pandemic.

- Climate change impacts: We are all aware of the massive climate change impacts on our eco system, whether it be in the form of droughts, forest fires, rising seas, or the excess energy in the atmosphere and thus more violent and destructive storms. All of this will result in mass migrations of both humans and animals. These massive disruptions, given our tendency of looking inwards by closing borders and ignoring our neighbors does not bode well for our future.

- State and local government financial predicament: With their finances already under strain from pension obligations and past mismanagement, the covid-19 crisis has been an incredible strain on local governments who have had to deal with much larger commitment towards first responders, cover testing, support for medical facilities, contact tracing and work on identifying and isolating patients to prevent spread. With a larger opposition from republican majority leader on bailing out state and local governments, it is not clear how much support they can get from the federal government, and without the ability to print money this is a crisis just waiting to unravel.

Response

Most governments have had a multi pronged response to the crisis:

- Health/Medical – The primary focus at the moment has been to manage the most severe symptoms from the disease and provide life support in patients under critical condition. This includes ventilator support once a patient’s lungs have been inflamed to a point where they are unable to exchange oxygen to support respiration needed for bodily functions. The focus has been on flattening the curve i.e. to slow down the infection rate so that the number of severely affected and critical patients does not exceed the local area hospital capacity, the ICU units and ventilators. In parallel there are efforts underway to discover both a vaccine and an effective cure or treatment for the disease. The human body’s immune system goes into overdrive and attacks the virus. In many cases, it may be this reaction that is fatal for the patient rather than the original infection. Remsidivir seems to be a promising treatment, although it only weakens the body’s immune system when attacking the virus – so not a real treatment to the disease but a remedy to one of our body’s critical response from the infection. Again we do not know much about how this works or the other impacts that the virus has on us. We have had reports of blood clots and arterial infection in kids similar to Kawasaki disease even when they haven’t exhibited any symptoms from the infection. The hardest part in controlling the infection in the population is that people who are infected and may not be exhibiting symptoms may still be passing on the infection to others. Hence the necessity of antibody test to determine if you have been infected. There also isn’t consensus on whether the antibodies produced from an infection results in immunity against the disease in the future.

- State/Immigration/Domestic Policy response – While I have mostly followed the government policy in the US, most countries have behaved similarly – closing borders, escalating trade tensions, a hardened response to immigration whether it be towards limiting net new immigration, or excluding immigrants from any fiscal policy responses that they have come up with. This absolutely does not help since infection in the immigrant community still causes the same kind of death, devastation and further infection potential as it would in the native population. There has also been a very stiff competition for acquiring medical equipment like ventilators, ppe and other testing supplies including a number of shady and unscrupulous players who have taken advantage of the desperate nature of the crisis.

- Fiscal Policy: I can describe the fiscal response in the US. Most other countries have enacted similar policies of fiscal stimulus, employment support and fiscal support in the form of loans or grants to small and medium scale businesses. The US congress initially started with $8.3 B funding for the public health agencies. It was followed up by a Family First Corona Virus Response Act for $192B. Next came the CARES Act costing about $2 T, followed by PPP- II for $483 B. Congress has passed another $3T package in unemployment support, fiscal help to families, state and local governments and other tax cuts. Not sure if this makes it all the way through (given the opposition in the senate and from the white house), although if the crisis worsens, a lot more people may come around to it.

- Monetary Policy (Items listed are Fed actions from before April 30, 2020): There has been a wide range of actions from the Fed towards a Monetary policy response. It started with the Fed reducing the Fed funds rate from 1.5% to almost 0 along with the guidance for rates to be low as long as necessary. The treasuries and mortgage backed securities that had become dysfunctional since the outbreak were supported by the Fed to the tune of $500 B in treasuries, and $200B in government guaranteed mortgage backed securities. On March 23rd the Fed increased its commitment to open ended support. Also extended support to include commercial mortgage backed securities, treasury securities and agency mortgage backed securities. The Fed next started the PDCF (Primary Dealer Credit Facility) for very low interest rate (0.25%) loans up to 90 days to 24 large financial institutions known as primary dealers. Next came the MMLF (Money Market Mutual Fund Lending Facility) lending to banks against collateral they purchase from primary money market funds. The Fed followed this up with Money Market Support with repo operations to funnel cash to money markets. The Fed then started direct lending to Banks, lowered the rate it charges banks for loans from its discount window from 1.75% to 0.25%. This was followed up by relaxing regulatory requirements to encourage dipping into regulatory capital and liquidity buffer so that they can increase lending during the downturn. PMCCF (Primary Market Corporate Credit Facility) is a program for direct lending to corporate employers by buying new bond issuance sand providing loans. Borrowers may defer interest and principal payments for at least 6 months to have the cash to pay employees and suppliers. SMCCF (Secondary Market Corporate Credit Facility) is used by the Fed to buy existing corporate bonds as well as exchange traded funds investing in investment-grade corporate bonds. With the CPFF (Commercial Paper Funding Facility) the Fed buys commercial paper, essentially lending directly to corporations for upto 3 months at a rate between 1-2% points higher than overnight lending rates. SMB loans are the Fed’s main street lending program, announced on April 9th and expands on April 30th, aims to support businesses too large for the small business Administration’s Paycheck Protection Program (PPP) and too small for the Fed’s two corporate credit cavities through new loans facility, expanded loans facility and priority loans facility for up to $600B in four year loans. For households & consumers the Term Asset-Backed Securities Loan Facility (TALF) helps support student loans, auto loans, credit card loans and loans guaranteed by the SBA. The Fed is also lending to the state and local governments through the Municipal Liquidity Facility created on April 9 and extended on April 27th. For Muni bond support, the Fed is also using two of its credit facilities to backstop munis. It expanded the eligible collateral for the MMLF to include highly rated municipal debt with maturities of up to 12 months, and also included municipal variable-rate demand notes. In addition for International Swap Lines, the Fed is making U.S. dollars available to other central banks, so they can lend to banks that need them. The Fed gets foreign currencies in exchange, and charges interest on the swaps. The Fed also is offering dollars to central banks that don’t have an established swap line through a new repo facility called FIMA (for “foreign and international monetary authorities”). The Fed will make overnight dollar loans to the central banks, taking U.S. Treasury debt as collateral. Finally, the Fed is also putting $2.3 trillion in lending on its balance sheet to support households, employers, financial markets, and state and local governments

- It appears that the executive, legislative and the monetary policy arms of the US government is literally throwing the kitchen sink at the problem to figure out what sticks. Eventually what will be needed is a full monetization of the fiscal deficit, if we are to move past this crisis.

Predictions

For the Economy:

- V-Shaped Recovery: A V-shaped recovery is a sharp downturn and then a very quick recovery. It is possible when structurally there is no problems with the economy or the markets and right after the pandemic is over, things get back to normal. It is hard to make this case at this point of time given that there will be lingering doubts about a second wave, or we would be muddling through with cases without a clear end. Also a vaccine or treatment is at least a year away, so the case for a V-shaped recovery appears implausible.

- U-Shaped Recovery – This is the case where there is a prolonged downturn, but after the crisis is over – things come back to the state it was before the crisis. This is also hard to argue for because a 15% unemployment for even a few months is a hard knock to recover from, given the average saved emergency fund for an American is not even $400. So a longer downturn means more bankruptcies, more food and housing insecurity and therefore not an easy path back to normalcy. Also given that we have had a business cycle boom for the last 10 years, a recession is overdue.

- I or L Shaped Recovery: This implies a sharp drop and the economy muddling through at the bottom. At this point this seems likely, given the incoherent policy from the federal government. Although the one contrarian point here is the unprecedented support from the Fed, even greater than the 2008 financial crisis.

- Greater Recession: In my opinion, this is the likely scenario. Given that there is nothing fundamentally wrong with the economy, the productivity gains we have had over the past decade are meaningful, although the unemployment and lack of emergency savings is definitely an issue. Hence the case for a longer recession.

- Greater Depression – this is unlikely given the extraordinary fiscal and monetary support to the economy described above from the lessons we have learnt from the 2008 financial crisis.

- Stag Depression – I do not believe we are going in for a stagflation depression. There is the case for inflation, given the massive amount of public debt. At some point of time, there will be a massive package of infrastructure investment to decarbonize the economy which will push up the productivity and the returns from such an infrastructure investment will prevent stagnation. It will be the case of the US having the cleanest of the dirty shirts and given that the $ still enjoys reserve currency status, stag-depression looks unlikely in my mind.

Trends in Response to the Crisis:

While these trends may not all pan out, it is important to call them out. These are emergent patterns, that the right players with some wind on their back can hope to capitalize and create a unique differentiated model for themselves.

- Globalization & Trade: We have seen a lot of anti globalization and protectionist trends manifesting themselves as either trade wars, or anti immigrant sentiments, hardening of immigration policy or pulling back from international commitments or global bodies. While it will be hard for companies to immediately move supply chains out of certain countries, given the need to preserve cash for contingencies, but longer term, everyone will be looking to de-risk their supply chains, if there is an outbreak in any one region of the world. Automation will certainly accelerate, especially in AI, Vision systems, self driving vehicles. Given the trends in automation and 3D printing, disruption is inevitable where any new product/need will create new workloads, new configurations of production that are much more automated and may be near shore instead of using the lowest cost supplier.

- Technology & Innovation:

- Manufacturing as we know will change with automation & 3D printing. Robots will be used for hazardous work/disinfection in rescue and disaster site, drones will be used for patrolling, thermal imaging, disinfecting, compliance to social distancing.

- Where and how we work will also change, given that most of us have proven to ourselves and our employers that we can be as effective working remotely as we were in the office. While there was a lot of hesitation initially when remote work started, where employees were worried about being out of sight, out of mind. But given that we were all forced into it, without any stigma, we have each discovered that not having to commute gives us a lot more time during the day for other pursuits, and it is possible to be as effective as before. Companies having discovered this as well, will look to reduce their physical office footprint and thus fixed costs.

- Video conferencing/ AR-VR will become mainstream especially with 5G rollout happening in most countries as this is being published.

- Another trend that will significantly accelerate is Gig or Job work instead of full time employment for a certain role. Companies at this point will not want to commit to hiring full time, but instead seek to define job specs for what they need in the short term and put this out to bid.

- There is an accelerated shift to digital currencies and online/virtual transactions given concerns about virus contamination on currencies. We have seen most retailers/suppliers/merchants completely move to digital payments at this time. It does not look to be a trend that will reverse.

- Supply chain auditing and assurance will take a completely new page given the fear from infection of the supply chain with covid-19. We have seen Amazon investing all of their Q1 profits into securing and strengthening their supply chain as an evidence of this change.

- Disruption from nimble operators with just good enough products and digital only footprints

- Moving to a more permissive ethical mindset especially given the moves towards location tracking and contact tracing

- Using AI in a big way for synthetic bio/drug discovery towards finding a cure/vaccine for covid-19, trends that will easily move to helping combat and prevent other diseases.

- Downturn drives Efficiencies

- Assets available for repurposing: Given the expectation that most commercial real estate will be looked at for continued investment, there will be a lot of assets that will be available for a different or novel use.

- Top talent would be more accessible: Given the economic disruption, and certain companies going out of business a lot of top talent will be available to take on new and different challenges.

- VC’s would be more discerning & stringent. They would only invest in compelling founders, startups and use cases.

- Disruption means opportunity: We have the opportunity to reinvent both healthcare and retail – both absolutely massive parts of our economy. The stimulus that is being put together as a part of the covid response, if repurposed for infrastructure and making us carbon neutral would also be transformational.

- Societal Impacts:

- Pandemic behavior influenced generations: Given this experience, generations ahead would have influenced their behavior to maintain social distances, be cognizant of personal spaces and even the regular dynamics of collaboration with others. Just like 9/11 changed the millennials, covid-19 will change our future generations.

- Personal & Group vendettas will be acted upon: The rhetoric against blue states, Asian Americans and USPS are some trends we see playing out. I do not expect these trends to change, given how polarized we have become.

- Worker Benefits/ Retirement Security/ Basic Safetynets and Universal Healthcare can become rallying cries for transformation and betterment of people’s lives.

- Focus on a clean and sustainable environment, given most people experienced how good a pollution free experience could be given the lockdown.

- Population density in the developing world will need to be addressed, given it is the fuel for this pandemic

- Migration and Immigration policies will have to be revisited, given the expectation of massive migrations that would be needed from effects of climate change.

- Role of corporates: Capitalism will need to adapt, where profits may not be the only objective. While maximization is important, understanding that their image, societal impact and responsibilities and profit extraction would be critical to maintain the ability to continue operating long term. There will also be pressure for multinational corporations to align to nation states and to identify with their biggest markets where they have to operate.

- Behavioral shifts:

- Polarization, Information &Trust: Given the polarization that we see in society, where we consume our information from will be fractured. There will not be a common set of understanding and agreement or even how we assign trust.

- What will work: Ultimately most factories will be automated. Even if they come back near shore, these are not bringing back huge employment opportunities. Field work may still need humans, till we have autonomous movement and operation with robots.

What is The New Normal?

- Population Pressure & Food: Presumably 7.8 billion is a lot of people and that puts a lot of pressure on our food supply to feed and care for this population. Consequently there is an increased pressure on meat production (given the preference of most countries to transition to a meat diet as the standard of living goes up) and also on agriculture where large tracts of land has had to be cleared to produce food for such a large population. It appears that we are straining the finite resources of this planet and subsequently having a catastrophic effect on the rest of the species inhabiting this planet. Already humans have been responsible for the extinction of a record number of species. In the short term it does not appear that we are slowing down our population growth and it may only be an external shock as in climate disasters or a shock to the food supply that may arrest this trend.

- Wild Habitat: Under pressure from human encroachment, most wild animals and retreating and species going extinct. Will we give some of these wild habitats back?

- Over fishing & the pressure on marine animals: Will humanity understand and responsibly manage fishing to be sustainable?

- Antibiotic Resistant Bacteria: Factory farms that produce meat and the ideal breeding grounds for bacteria, and given the indiscriminate use of antibiotics for keeping the meat production up, this leads to development of strains of bacteria that are antibiotic resistant. Will we find newer antibiotics or shift away from factory farming of animals for meat?

- Climate Change: Animal and human migrations will result from climate change related catastrophes and disasters. The thawing Tundra is expected to release additional microbes that have not been seen before and could also rival this pandemic.

- Globalization: Will a crisis push globalization to extinction i.e. the specialization of providers for goods and services recedes given our response has been protectionist and to close our borders?

- Travel, Leisure and Exploration: Will all travel become local? What will be the future of air travel / mass transit? Will telepresence for work translate to experiencing travel and leisure the same way? Seems unthinkable right now, but you never know ….

As always, welcome any feedback, contrarian points of view and a healthy discussion…

Science Olympiad Protein Modeling

This year, I participated in Science Olympiad, which is a high school competition testing science knowledge in a variety of fields. I, along with my friends Ayush and Andrew, competed in the Protein Modeling event. Our task was to create a physical model of a protein, and take an onsite test at the competition testing our knowledge of protein modeling software and the protein itself. The protein that we were given this year is called APOBEC3A, which is a type of cytidine deaminase.

Cytidine deaminase is a very interesting protein. It has the ability to turn a cytosine nucleotide into a uracil nucleotide. This ability caught the eyes of researchers, as they realized it could be used in gene editing. Cytidine deaminase succeeds where CRISPR-Cas9 fails-making specific, targeted, one base pair changes in the genome. Researchers were able to fuse cytidine deaminase and an inactive variant of Cas9 to do exactly that. This new mechanism is called base editing.

Base editing has a lot of implications for many fields in medical research. One of those fields is cancer research.

My Research Project: Microbial Fuel Cells

For my sophomore research class, I did a project testing the effect of anode surface area on microbial fuel cells, or MFCs. MFCs are an experimental fuel cell type that use bacterial respiration to generate electricity. Basically, in an MFC, bacteria and sugar are placed in a chamber without oxygen with two electrodes on either side. The bacteria form a biofilm on the anode side and transfer electrons from anaerobic respiration to the anode. The cathode, which is made of platinum, is exposed to air. The platinum cathode uses the flow of electrons through the cathode to catalyze the reverse half reaction in the cell. I 3D printed two MFCs for this project. One of my MFCs had a larger surface area anode, which I hypothesized would increase biofilm formation and thus power output. As my bacteria source, I used pond sludge and mixed it with a glucose solution. I ran both fuel cells for two days, taking power readings every minute.

This was one of the most rewarding and exhilarating experiences of my life. I learned a lot about the engineering design process while designing the fuel cells. I also learned a lot about electrochemistry and circuit design while learning about MFCs. While my idea did not show that the high surface area anode increases power output, I would like to continue this project and make modifications to it to see if I can increase power output. One idea that I have is to coat the anode with gold nanoparticles, which should increase surface area at a nanoscale, which could improve biofilm formation. I really enjoyed this project and I am planning to do much more like this in the future.

Future of On-boarding Systems at Banks and Financial Institutions

I spent a number of years building on boarding systems for a large investment bank. When I came into the role, the immediate need was to implement FATCA across a spectrum of on boarding systems, all on different tech stacks, multitude of features and functions but none able to support all of our products. This fragmentation came about because of budget pressures, needs from various product areas, separate IT teams and the lack of hygiene discipline to sunset old and end of life systems.

While we were successful in creating a state of art on boarding platform, and a scalable, flexible regulatory program framework that could handle the changing regulations from regulatory regimes across the globe, and also in bringing all of our client facing product groups to our platform; the question that kept nagging me was – is this adding to our sustainable competitive advantage?

The answer that I arrived at was – No. This is an example of an industry-wide trapped value. Every firm on the street on boards clients and creates accounts. While clients aren’t thrilled about the experience and the documentation needed, most comply, since they could not trade without this. But reasonably assuming every client has relationships to multiple brokers and/or banks – why should they be subject to multiple disjointed onboarding experiences, with every firm asking for KYC (and other regulatory programs) documentation? Therefore, there is

In my opinion, this screams of an industry wide shared service, where clients get FATCA/KYC/MiFID certified just once and use these certifications across multiple brokers or banks. This ideally is a digital asset – a compliance certificate for any regulatory program across any regime from a shared service provider that is available to query and is immutable. The individual players can then use this digital asset as an underlying precondition in their trading/transaction/lending/advisory businesses. It should then be very trivial to move the regulatory compliance costs to the shared service provider, and given the multiple clients using the service, would lead to an overall cost reduction in banking/trading/advisory sectors. The client would also be happy, given a single point for regulatory program check and compliance.

An implementation using smart contracts on an immutable blockchain that is available to all parties, reflects real time compliance stats and allows brokers and banks to rely on this to facilitate their business would be much more efficient and this seems to be the reasonable evolution for this function.

Welcome any feedback or contrarian views…